The Key KPIs That Matter Most in M&A for Acquirers

Acquirers don’t just look at revenue—they focus on a set of critical KPIs

Subscribe: If this newsletter was forwarded to you, subscribe here.

When it comes to M&A transactions, acquirers don’t just focus on top-line revenue—they analyze key performance indicators (KPIs) that determine a company’s sustainability, profitability, and scalability.

If you're a founder planning an exit or an investor evaluating deals, understanding these metrics is critical for maximizing value

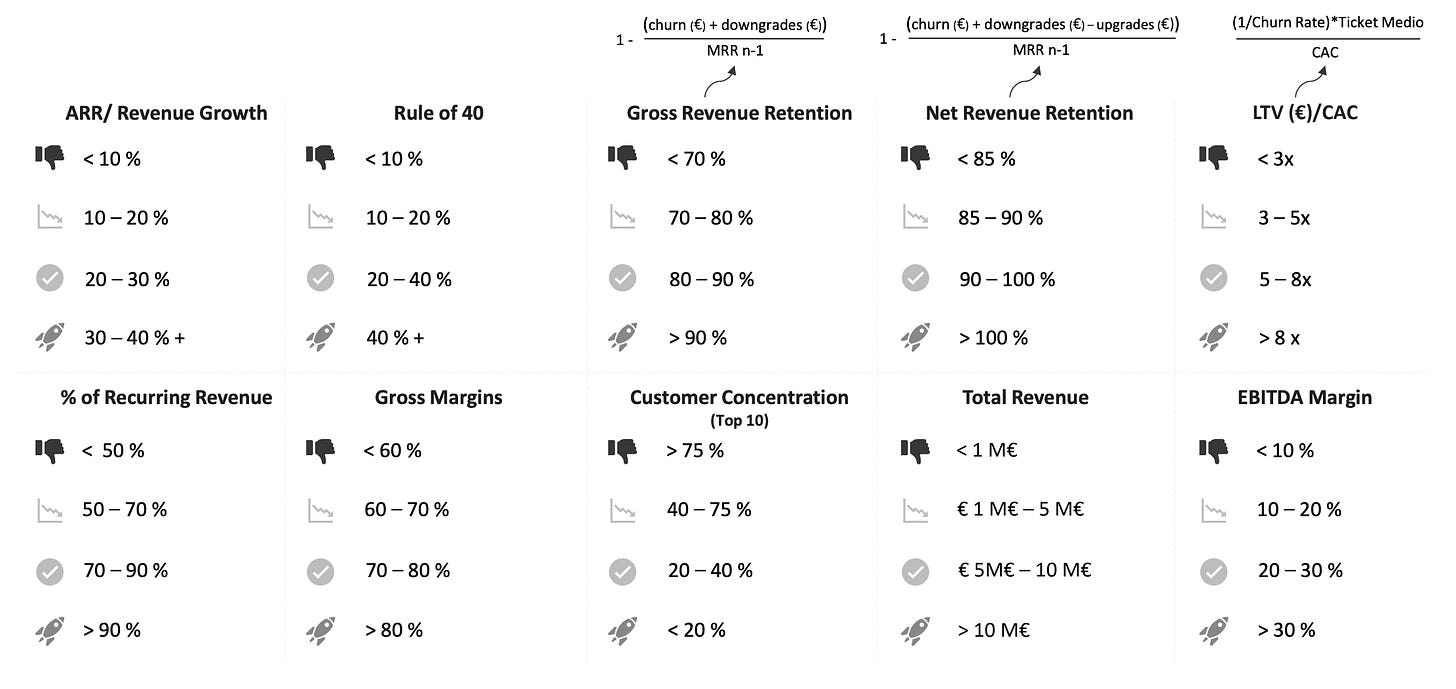

The Most Relevant KPIs in M&A

-ARR / Revenue Growth

High-growth companies (+30% YoY) are more attractive, but predictability is key.

Sustainable, recurring revenue wins over short-term spikes.

-Rule of 40

Growth rate (%) + EBITDA margin (%) should exceed 40%.

A strong balance between growth and profitability signals financial health.

-Gross & Net Revenue Retention

Gross Retention >90% ensures customers stay.

Net Retention >100% means customers expand their contracts—driving long-term value.

-LTV/CAC Ratio

A 5x+ ratio indicates strong unit economics—each customer generates significantly more than their acquisition cost.

-% of Recurring Revenue

Companies with >90% recurring revenue (subscriptions, SaaS, etc.) get higher valuations due to predictable cash flow.

-Customer Concentration

Revenue dependency on a few clients (>75%) is a red flag.

Diversified customer bases reduce risk and enhance deal attractiveness.

-Total Revenue & EBITDA Margin

Companies with $10M+ in revenue and >30% EBITDA margins attract premium valuations.

Why These KPIs Matter

For founders, optimizing these metrics before an exit can dramatically increase valuation and buyer interest.

These KPIs act as filters for investors and acquirers to identify high-potential companies while avoiding risky bets.

💡 If you’re considering an M&A transaction—whether selling, buying, or investing—understanding these KPIs can make all the difference.

Let’s connect if you’d like to discuss how to optimize these metrics for a successful deal! 🚀

Share this Newsletter!

If you found this useful, don’t hesitate to share it with others in your network.